|

| Minister King in Japan spruiking gas. Source: X |

Meanwhile Minister for Energy and Resources Madeleine King is in Japan talking up and selling Australian gas expansion and repeating some lies such as Australian gas is needed to keep the lights on.

The incongruiety was highlighted in a tweet by Roderick Campbell, Research Director of the Australia Institute:

While Albo was in Samoa 'addressing climate change', Madeline King was in Japan promoting the 'Future Gas Strategy'.

— Roderick Campbell (@R_o_d_C) October 24, 2024

Aus Gov looks after Japanese gas cos, not the Pacific.https://t.co/yDZiHotkoL https://t.co/Dt1yMB8Co8 pic.twitter.com/mV827ULuK5

Lets get some facts straight:

Gas use in Japan has been falling since 2014.

Japanese companies has overcontracted Australian gas and now on-sells more gas than it imports from Australia along with gas infrastructure to other Asian countries. They are exacerbating dependency on gas in Asia and increasing the climate crisis.

Gas as exported LNG is 33 per cent greater life-cycle emissions than coal.

Over half (56%) of gas exported from Australia attracts zero royalty payments, effectively giving a public resource to multinational corporations for free.

Australia's Future gas strategy is not a pathway to reduce emissions and over-estimates the need for gas in the domestic energy transition.

Expanding gas production with $1.9 billion in Federal infrastructure subsidies for Middle Arm and other hubs turns the Northern Territory into a sacrifice zone, that will have a destructive impact on the environment, cultural heritage and communities.

A recent FoE Japan report highlights Japanese government investment through its 100% ownership of the Japan Bank for International Cooperation (JBIC) in new gas infrastructure in the Northern Territory:

"A recent memorandum of understanding between JBIC and the Northern Territory Government of Australia suggests JBIC is considering financing the Northern Territory Government’s proposed gas export and petrochemical facility at Middle Arm in Darwin Harbour. Locals are concerned about impacts on the harbor and on the health of Darwin residents, some of whom live within a few kilometers of the site. A key tenant at Middle Arm is Texan fracker Tamboran, who proposes a new LNG facility of up to 20 Mtpa at Middle Arm, fed with fracked gas from the Beetaloo Basin. Traditional Owners in the Beetaloo Basin object to fracking on their country. Beetaloo fracking projects threaten extensive and interconnected groundwater and river networks.

JBIC’s extensive financing of gas projects in Australia has caused significant environmental and cultural damage, highlighting the urgent need for Japan to stop fossil gas financing."

JBIC also has substantial investments in the Western Australian gas projects:

JBIC has been central to the rapid expansion of gas projects that has made Australia one of the world’s biggest LNG exporters. Since 2010, JBIC has provided $9 billion to gas projects in Australia.

JBIC is deeply involved in Woodside’s Burrup Hub gas export precinct, which if fully built would produce lifetime emissions of 6.1 billion metric tons. Burrup Hub would be the largest gas carbon bomb12 in the Southern Hemisphere and would use up a sizable amount of the world’s remaining 1.5°C carbon budget. The Burrup Hub projects also pose significant threats to marine ecosystems and to priceless 50,000 year old Aboriginal rock carvings.

Feeding into the Burrup Hub is the Scarborough Gas Project, the largest fossil fuel project currently under development in Australia. In 2024, JBIC announced financing totalling $1.8 billion to Scarborough, including $1 billion to Woodside, which is the Australian company leading the project. Over its lifetime to 2055, the Scarborough project would lead to 1.37 billion metric tons of emissions released into the atmosphere, nearly three times Australia’s entire national annual emissions.

JBIC is also financing Browse, the largest unexploited conventional gas field in Australia, which would operate for over 40 years with lifetime emissions of up to 1.6 billion metric tons. Browse gas would need to be pumped nearly 1000 km by subsea pipeline for export via the Burrup Hub.

A short timeline for Japan and Australian gas

17 October 2024 - New report on how Japan is fuelling gas expansion. Faces of Impact: JBIC and Japan’s LNG Financing Harms Communities and the Planet. Discusses communities in several countries. For Australia it discusses Scarborough Gas, Burrup Hub and the Browse gas project, and NT Middlearm hub. "A recent memorandum of understanding between JBIC and the Northern Territory Government of Australia suggests JBIC is considering financing the Northern Territory Government’s proposed gas export and petrochemical facility at Middle Arm in Darwin Harbour." (Fossil Free Japan)

7 October 224 - Japan backs fossil fuels in Southeast Asian “zero emission” initiative. Japan’s Asia Zero Emission Community (AZEC) supported 56 projects using fossil fuel technologies in Southeast Asia — including LNG and carbon capture (Climate Change News) Zero emissions or fossil fuels? Tracking Japan’s AZEC projects. Results show AZEC is supporting prolonged fossil fuel use (Zero Carbon Analytics)

23 September 2024 - Japan’s persistent fossil fuel subsidies threaten industry competitiveness and decarbonization goals (IEEFA)

- Japan's electricity, gas, and petrol subsidies to curb inflation are counterproductive to its decarbonization goals and burden the country’s primary balance.

- The country’s continued reliance on imported fossil fuels, alongside a weakening Japanese yen, caused the trade deficit to hit a record high in 2022. Prolonging fossil fuel subsidies worsen these economic issues and negate any benefits of addressing climate change.

- Japanese companies are increasingly concerned about the low capacity of renewable energy and missing out on potential economic benefits in the rapidly evolving green global economy.

- A more coherent long-term inflation strategy would redirect subsidies toward investments in renewable energy to improve Japan's energy self-sufficiency, primary balance, and industrial competitiveness.

5 September 2024 - new report on Japanese fossil fuel finance around the world - $93 billion over 10 years. Japan is purchasing Australian LNG and onselling to Asia. Billions Off Course: Japan's Oil and Gas Financing Fueling the Climate Crisis (For Our Climate)

Executive Summary:

- In recent years, Japan has become one of the largest global financiers of fossil fuels, particularly of oil and gas. Despite international efforts to address the impacts of fossil fuels and Japan's G7 commitment to end fossil fuel financing in 2022, Japanese export credit agencies (ECAs) continue to fund oil and gas projects worldwide. This report examines Japanese investments in oil and gas, analyzing trends over the past decade.

- Between April 2013 and March 2024, Japanese public financiers provided approximately $93 billion for overseas oil and gas projects. Yearly financing amounts declined in the past few years, however spiked in financial year of 2023 at $5 billion. This report attributes this recent increase in oil and gas finance to Japan’s "energy security" narrative, which became pervasive following the breakout of the Russia-Ukraine war in 2022 and the fuel price crisis that followed it. Japan’s newly adopted Green Transformation (GX) policy, encouraging gas resource development, also informs additional financing for oil and gas.

- The majority of financing was for gas projects ($56 billion), outweighing financing for oil projects ($26 billion). Financing for combined oil and gas projects made up the rest. The top financier was Japan Bank for International Cooperation (JBIC), primarily through loans. As for value chain, upstream projects received the most finance, and analysis by geographic region reveals Asia and the Pacific was the top leading recipient by financing amount, followed by Middle East & North Africa.

- However, Japan’s domestic demand for LNG has been decreasing, and the country has been over contracted in LNG. This has led to Japan re-selling its LNG imports to countries in South and Southeast Asia, further working with and through corporates such as JERA, Mitsubishi Heavy Industries (MHI), and others to secure demand in these countries by participating in and developing fossil fuel projects in the region. Numerous ongoing projects indicate that future Japanese LNG financing will likely remain high.

- As renewable energy already became cheaper than gas, the unnecessary costs of LNG development may fall on Japanese entities or local taxpayers in destination countries. The profitability of oil and gas projects is questionable given the expected decrease in demand and increase in supply, posing stranded asset risks, especially in the midstream sector.

- Japanese oil and gas financing overlooks climate commitments and negatively impacts global communities and environments, exposing Japan to reputational risks. Japan’s financing for oil and gas projects is directly violating rights of indigenous people and local communities, and is detrimental to energy transitions globally, and in Asia in particular. This financing also creates political risks for Japan, which is promoting a fossil fuel agenda in bilateral and multilateral discussions.

- In conclusion, we recommend that Japan adopt restrictions on all international fossil fuel financing, including for CCS and hydrogen projects, and push for OECD-wide restrictions on oil and gas. Japan should accelerate the regional transition to renewable energy and disclose its annual financial support for fossil and clean energy projects, to support global sustainable development goals.

5 September 2024. New report on the gas sector. With proposals to import gas this new report shows the farce and political failure in managing and regulating gas industry. Around 80% of Australia’s gas is exported as liquefied natural gas (LNG). Over half (56%) of gas exported from Australia attracts zero royalty payments, effectively giving a public resource to multinational corporations for free. Across the country, gas and oil extraction employs just 21,200 workers — less than half of one percent (0.15%) of the 14 million people employed in Australia. (Australia Institute)

12 June 2024 - Climate Council report on powering past Gas to counter the Federal Government Future Gas Strategy arguments that we need to expand gas production (Climate Council)

"The Australian Government’s Future Gas Strategy, released in May 2024, pays far too little attention to the huge opportunities created by electrification and fuel switching, which will continue to slash demand for gas – both in Australia and internationally. Worse, it also assumes we will dig up, sell and burn huge amounts of gas long into the future, and recommends the development of new gas fields in Australia to provide this supply

"Gas has a small and shrinking role to play in our future clean energy mix. This report shows how we can balance our energy needs on the way to a cleaner energy system and take charge of the change that is underway in global energy markets. We can make better choices today which will protect our kids from more climate pollution and step decisively towards the next era of Australian prosperity. A real strategy for the future of gas in Australia is one that powers us past this polluting fossil fuel and into a cleaner energy system."

17 May 2024 - IEEFA. Japan does not need Australian LNG to keep the lights on in Tokyo (IEEFA)

- The Australian government’s Future Gas Strategy anticipates continued demand for LNG exports, but IEEFA research suggests our biggest export market, Japan, is already in decline and over-supplied.

- Japan’s LNG demand dropped by 25% since 2014 and is expected to drop by a further 25% by 2030.

- Japan is already over-contracted in LNG, and resells more LNG overseas than it imports from Australia.

- Japan will have many suppliers to choose from in a soon-to-be-oversupplied global LNG market dominated by low-cost producers.

An Excerpt:

Nuclear generation in Japan has been steadily increasing as reactors are progressively brought back online. Two units were restarted in 2023 and the active fleet also increased its utilisation. Another 11 reactors are undergoing review.

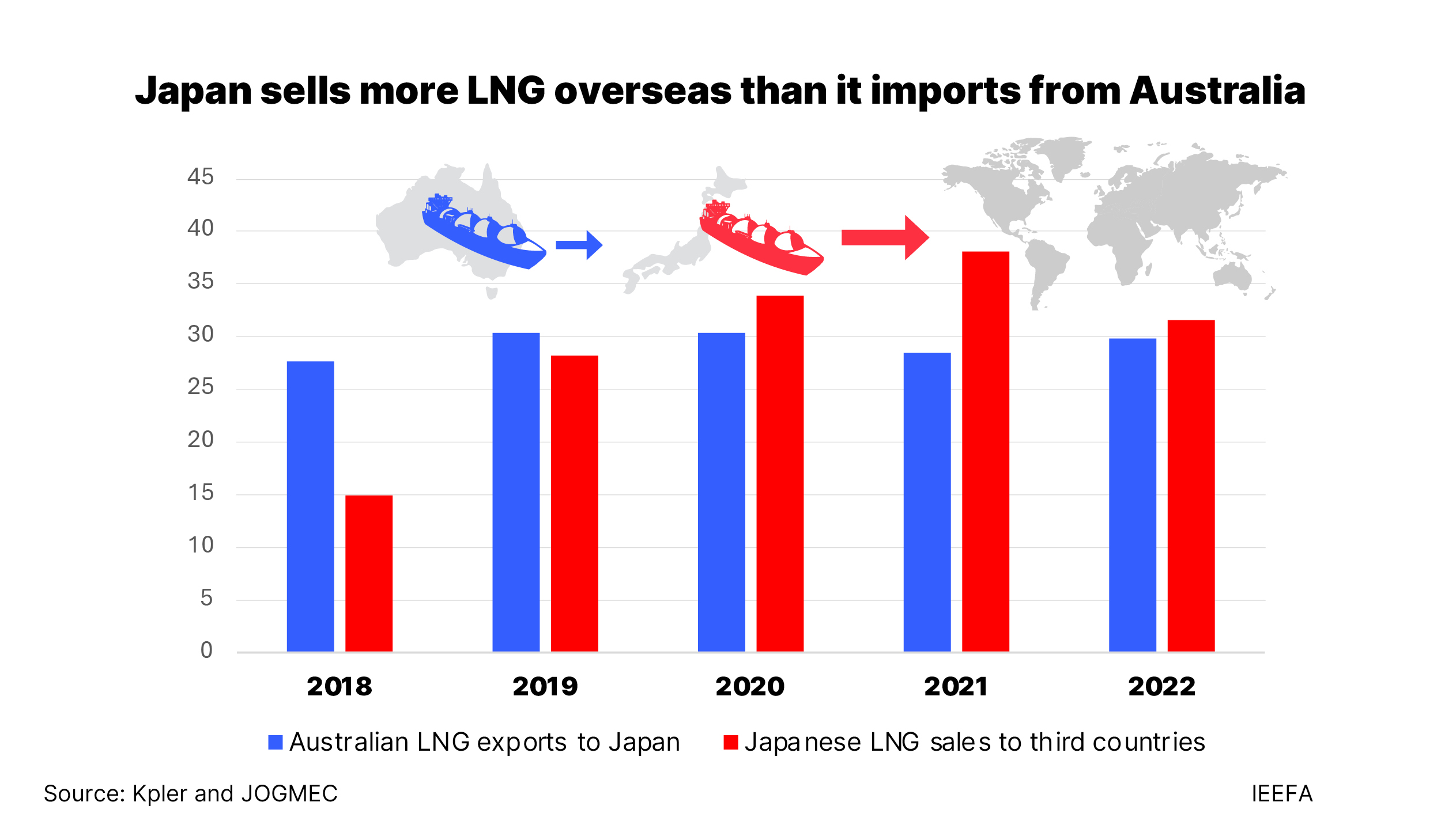

The resultant fall in LNG demand means that Japanese buyers have found themselves over-contracted, and are increasingly reselling the gas overseas. IEEFA has found that Japanese companies sold more than 30 million tonnes (mt) to third countries in FY2020, FY2021 and FY2022, peaking at 38mt in FY2021. This is more than Australia’s total LNG exports to Japan over those three years.

The surplus LNG is often sold in Southeast Asia where Japanese utilities are cultivating demand. IEEFA found that Japanese “utilities are investing in midstream and downstream gas infrastructure, such as regasification terminals and LNG-fired power plants and offering engineering and consulting services to inform energy and power roadmaps across the region. […] Corporate strategies for Japan’s major LNG buyers aim to tilt revenue share towards overseas revenues.”

Figure 2: LNG sales by Japanese companies to third countries compared to Australian LNG exports to Japan, mt

11 March 2024 - IEEFA. Japan's largest LNG buyers have a surplus problem (IEEFA)

- Japan’s demand for liquefied natural gas (LNG) has fallen rapidly in recent years, marking an important shift in global markets. Japanese utilities — once considered purely consumers of LNG — are increasingly focused on marketing and reselling the fuel abroad, putting them in more direct competition with global suppliers.

- IEEFA finds that the over-contracted position of Japan’s four largest utilities — JERA, Tokyo Gas, Osaka Gas, and Kansai Electric — could increase in the coming years. Their emphasis on overseas growth is driven by declining opportunities in Japan’s domestic gas market.

- With a flexible surplus of LNG, these Japanese utilities are looking to cultivate demand in Asia’s emerging markets. As demand from Japan and other key markets wanes, prices are widely expected to fall over the remainder of the decade. LNG marketers, which increasingly include Japanese utilities, could see sales margins drop and potentially turn negative.

No comments:

Post a Comment